Don't Get Trapped...

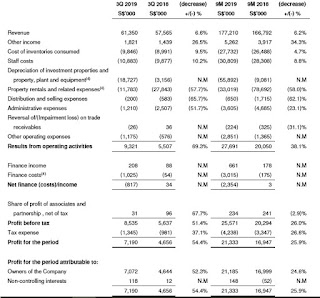

Yesterday, during our FATA Seminar 's Stock Discussion, we discussed about some companies and I pointed out some of their issues in the financials. Do note that for our FATA Seminar, we will allow participants to ask about some companies. After which we will discuss about these companies' FATA prospects. Many of the issues came from S-Chips' financials, which many had already cautioned about. However, we discussed about this Singapore company's in the F&B sector, where I mentioned about some figures in the financials that were presented very interestingly. Income Statement Balance Sheet Cashflow Part 1 Cashflow Part 2 Share Price since IPO - Source: Yahoo Let me explained some of the interesting findings: 1. Changes in financials occur due to SFRS 16: Leases 2. Previously, leases were stated under operating leases - these were expenses. Currently, they are capitalised - these became assets under PPE. 3. Under income statement,