Big Idea 3

After writing about Big Idea 1 and Big Idea 2, I will talking about the next Big Idea.

Big Idea 3 is actually quite a new company in my portfolio. I have only held it for about 1 month.

It was also never mention in any of my portfolio listing. Upon checking, I realize that I have only written about this counter in a 2015 post.

Reasons Why This Counter Qualifies as a "Big Idea"

1. Discovering Its Moat

I must confess that this company do not really have a significant moat. In fact, its industry have a low barrier of entry.

However, as this company sells a "luxury niche product", it creates an invisible barrier of entry. This is because consumers will not just go to any shop to buy this "product". They tend to choose renowned shops that they TRUST to buy this "product".

Since it is also a "luxury niche product", not anyone can just straight away open a new shop to sell this "product".

In my opinion, this company is also a market leader within this "luxury niche product" space.

Thus, with a company's name that is easily recognised by consumers intending to purchase this product and also being the market leader within its space, I believe these are possibly the company's moat!

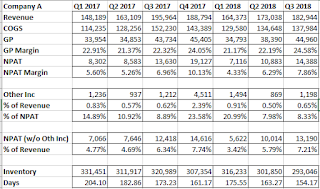

2. Improving Margins + Better Than Its Direct Competitor

Firstly, you will notice that the company's Gross Margin and Net Profit are improving over the last 3 quarters. If you compare it to 2017 4th quarter, there is a high possibility that the next quarter's Gross Margin and Net Profit could improve further.

Next, if you compare the company's margin against its direct competitor's margin, you will realise the company is performing much better even though their Gross Margin is almost the same.

Finally, even if the company's "other income" is removed, which in this case is rental income, the Net Profit is still much better than its direct competitor.

3. Management's Words

If you knew which company I am talking about and you read the 2017 annual report's Chairman letter, it have stated that the goal is to reduce the inventory turnover days.

Thus, from the above analysis, the inventory turnover days have reduced significantly every quarter and it is also been faster than its competitor.

With the above improvement in inventory turnover days, I will gladly ASSUME that if the company continue to perform "similarly", the 4th quarter financials will be satisfactory for the investors.

In Short

The above stated reasons are explanations of why I decided to list this counter as one of my Big Idea. Do note that there are still many potential reasons to why I invested in this counter.

Regardless, it is good to note that I do not think the above reasons indicates that the company does have a great moat. But I believe, even without a significant moat, it qualifies as a Big Idea due to its improving margins and financials.

Do note that its full year results will be coming out this month.

Please do your own due diligence before you invest this counter (if you knew what it is).

If you are interested to know more about The Ultimate Scorecard or Full Analysis, do visit the Fundamental Scorecard website for more information! Do sign up to get the latest scorecard of all the SGX counters now! Only about $10 a month!

You can also purchase a copy of our Guide to SG Stock 2018 for only $8 via this link.

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Big Idea 3 is actually quite a new company in my portfolio. I have only held it for about 1 month.

It was also never mention in any of my portfolio listing. Upon checking, I realize that I have only written about this counter in a 2015 post.

Reasons Why This Counter Qualifies as a "Big Idea"

1. Discovering Its Moat

I must confess that this company do not really have a significant moat. In fact, its industry have a low barrier of entry.

However, as this company sells a "luxury niche product", it creates an invisible barrier of entry. This is because consumers will not just go to any shop to buy this "product". They tend to choose renowned shops that they TRUST to buy this "product".

Since it is also a "luxury niche product", not anyone can just straight away open a new shop to sell this "product".

In my opinion, this company is also a market leader within this "luxury niche product" space.

Thus, with a company's name that is easily recognised by consumers intending to purchase this product and also being the market leader within its space, I believe these are possibly the company's moat!

2. Improving Margins + Better Than Its Direct Competitor

|

| Counter's Financial |

|

| Direct Competitor's Financial |

Firstly, you will notice that the company's Gross Margin and Net Profit are improving over the last 3 quarters. If you compare it to 2017 4th quarter, there is a high possibility that the next quarter's Gross Margin and Net Profit could improve further.

Next, if you compare the company's margin against its direct competitor's margin, you will realise the company is performing much better even though their Gross Margin is almost the same.

Finally, even if the company's "other income" is removed, which in this case is rental income, the Net Profit is still much better than its direct competitor.

3. Management's Words

If you knew which company I am talking about and you read the 2017 annual report's Chairman letter, it have stated that the goal is to reduce the inventory turnover days.

Thus, from the above analysis, the inventory turnover days have reduced significantly every quarter and it is also been faster than its competitor.

With the above improvement in inventory turnover days, I will gladly ASSUME that if the company continue to perform "similarly", the 4th quarter financials will be satisfactory for the investors.

In Short

The above stated reasons are explanations of why I decided to list this counter as one of my Big Idea. Do note that there are still many potential reasons to why I invested in this counter.

Regardless, it is good to note that I do not think the above reasons indicates that the company does have a great moat. But I believe, even without a significant moat, it qualifies as a Big Idea due to its improving margins and financials.

Do note that its full year results will be coming out this month.

Please do your own due diligence before you invest this counter (if you knew what it is).

If you are interested to know more about The Ultimate Scorecard or Full Analysis, do visit the Fundamental Scorecard website for more information! Do sign up to get the latest scorecard of all the SGX counters now! Only about $10 a month!

You can also purchase a copy of our Guide to SG Stock 2018 for only $8 via this link.

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Comments

Post a Comment