Buy The Dip? Ask The Men In Suits.

Not sure how the market will be doing at the point of you reading this. I could be late in writing about this. Nevertheless, I thanked for your time in reading.

I will be writing to explain about my opinions about the continuation of the current dip.

So... here we go!

Definition: Men In Suits sit behind the computer and work in the hedge funds, the institutions, the investment banks, in Wall Street, etc

Expectations

I have watched many Youtube videos on the dip. Many explained about the yield and inflation, which was explained in my previous post.

But if we think deeper, the reasons behind the dip is all due to the EXPECTATIONS from The Men In Suits.

They expected the inflation to arrive in the future. Thus, that is why many of them wanted higher yield for super long term bonds. Why will they want to be something that will give us 1.5% when we know the inflation in the long term is 2%? This make sense.

However, as an average joe, I don't even know what will I be having for lunch tomorrow.

Lets' also not forget about the Global Economy. The world is still closed. How many of us want to travel but can't? There are like new strains of the virus in news and here they are worried about what is the inflation in 5 to 10 years.

Thus simply, in my opinion, these are a result of expectations of Men In Suits.

Share Price Is A Predictor

Last April/May period, I was super puzzled about why is world closing down with totally almost no business activities, but the share prices were increasing.

Watching an interview with Aswath Damodaran helped. He reminded me, the share price is always a future predictor of the future economy in 3 to 6 months time. And he also mention, the share price may also predict WRONGLY.

This meant that it could have predicted wrongly now for this dip or predicted wrongly when the Nov 2020 surges in share prices occurs.

In my opinion, I seriously don't see how we could be doing much worse in the future 3 to 6 months time with vaccines and gradual opening of economy.

Valuations

Once again, Men In Suits are back in the picture.

In the past, when the Men In Suits wanted a more mechanical way of understanding share price. They created the Discounted Cashflow Calculation. It is a formula to calculate the fair value, or in my view, "the subjective number you need to convince yourself to buy, hold or sell" of a company.

I will not go into the formulas but in short, if Men In Suits believe the future cash earnings will be deemed to be valued "lower" due to inflation or high bond yield (aka risk free rate), this meant that the valuation of the company will be lower (1) WITHOUT ANY CHANGE IN FUNDAMENTALS or (2) ANY FAULT of THE COMPANY.

That is why many cash burning companies like the Tech companies (more earnings are expected in future with the current cash burning) are being punished without any change in fundamentals.

In my opinion, valuations are subjective, period. That is why Fundamental Scorecard uses 5 different calculations to come up with the intrinsic value. (If you are interested, google on Fundamental Scorecard and you can visit the website to know more or join our Telegram Group.)

Oil Prices and Recovery Stocks

Let's not forget about the current increase in Oil Prices and the share prices of many recovery stocks like Cruise and Airlines.

|

| Taken from FT.com |

Let's also not forget that Oil Prices went into negative zone in 2020 and many of the airlines/cruise have yet to have a full plane/ship of passengers.

In my opinion, how flicker-minded can the Men In Suits be?

Conclusion

In short, if you like to know if you should buy the dips, ask the Men In Suits.

On the other hand, you can be like me (if more dips arises):

1. Strive to be an independent thinker. Humans are never really good at predicting and tends to be over-confident with their expectations.

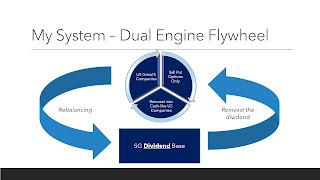

2. Have a strategy and a system in place - continue to place your belief in them.

3. Increase your cash pile by selling your companies with a cash-like feature. I used to buy FAANG as a cash like feature investment, which meant that in times of need, I will sell them.

4. Take the opportunity to understand which are your higher conviction companies in my portfolio. Those that you still have conviction in even if the share price has dropped significantly.

5. Potentially, you can choose to sell those companies that you have low convictions and continue to build the positions of the highest conviction companies in your portfolio.

6. Ignore the Men In Suits.

If you are interested, please do bookmark this Blog or follow me on TUBInvesting FB, or Fundamental Scorecard Telegram Group (please google for the links!).

Stay tune for my next post!

Comments

Post a Comment